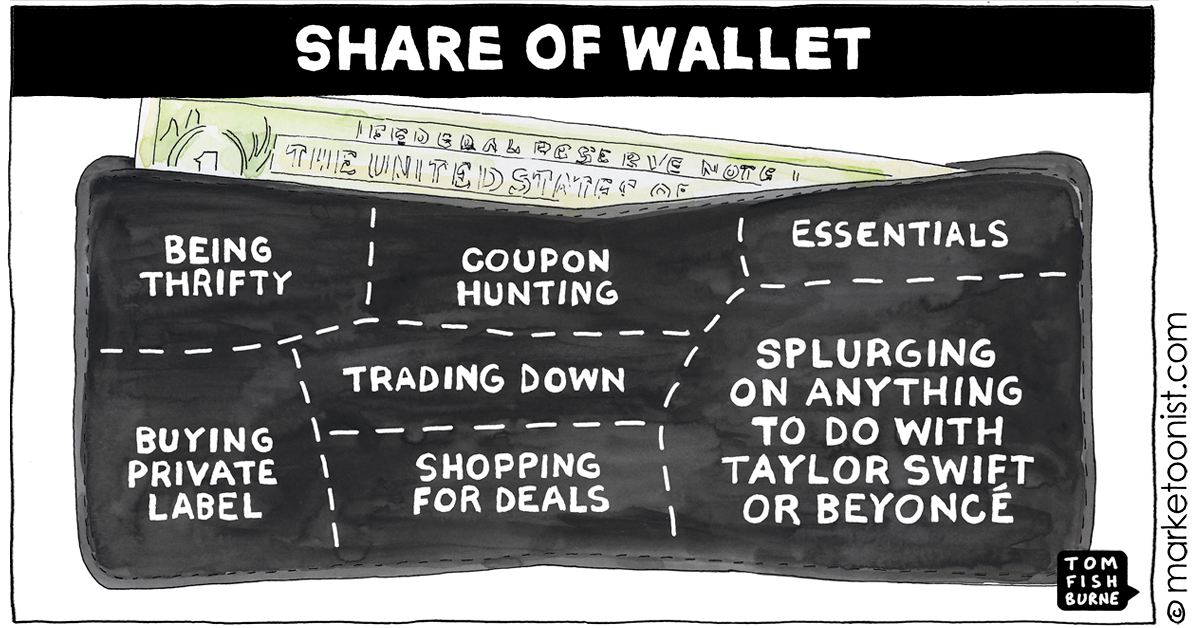

Kevin Jordan-Deen, SVP at Colgate-Palmolive, encouraged me last week to re-imagine and re-create a “Share of Wallet” cartoon I originally drew in 2009 during the “Great Recession”.

When I drew the original cartoon, I was GM for the recently launched Method brand in the UK. Much of the recessionary marketing climate at the time was centered on belt-tightening, private label and deep promotions, particularly in the Home and Personal Care categories where I worked.

And yet, despite the value focus everywhere, everyone seemed to find the budget to splurge on a new iPhone. That juxtaposition was the original punch line of the cartoon in 2009.

Kevin (coincidentally now also working in Home and Personal Care) notes a similar climate today, with plenty of thrifty shopping behaviors on display. But instead of the iPhone, consumers have been splurging on Beyoncé, Taylor Swift, “Barbenheimer”, and other experiences.

Last week, James Knightley, chief economist at ING, specifically called out Taylor Swift, Beyoncé, and “Barbenheimer” for helping US GDP grow 4% last quarter.

In overall consumer spending, Beyoncé’s “Renaissance Tour” generated $5.4 billion, Swift’s “The Eras Tour” $4.6 billion, and “Barbie” and “Oppenheimer” $3.1 billion. And these are just the biggest headline events to represent rising consumer spending on experiences, including everything from NFL games to Disney theme-park visits.

Analysts have dubbed this phenomenon “Funflation.” Average ticket prices for live entertainment have climbed 19% since 2019.

Best Buy CEO Corie Barry even name-checked both “Funflation” and “Taylor Swift” this week as a reason for the retailer’s sales slump.

As she put it:

“Funflation, Taylor Swift … those experiences are really where people are willing to pay. Bigger ticket items in electronics are not right now where people are interested.”

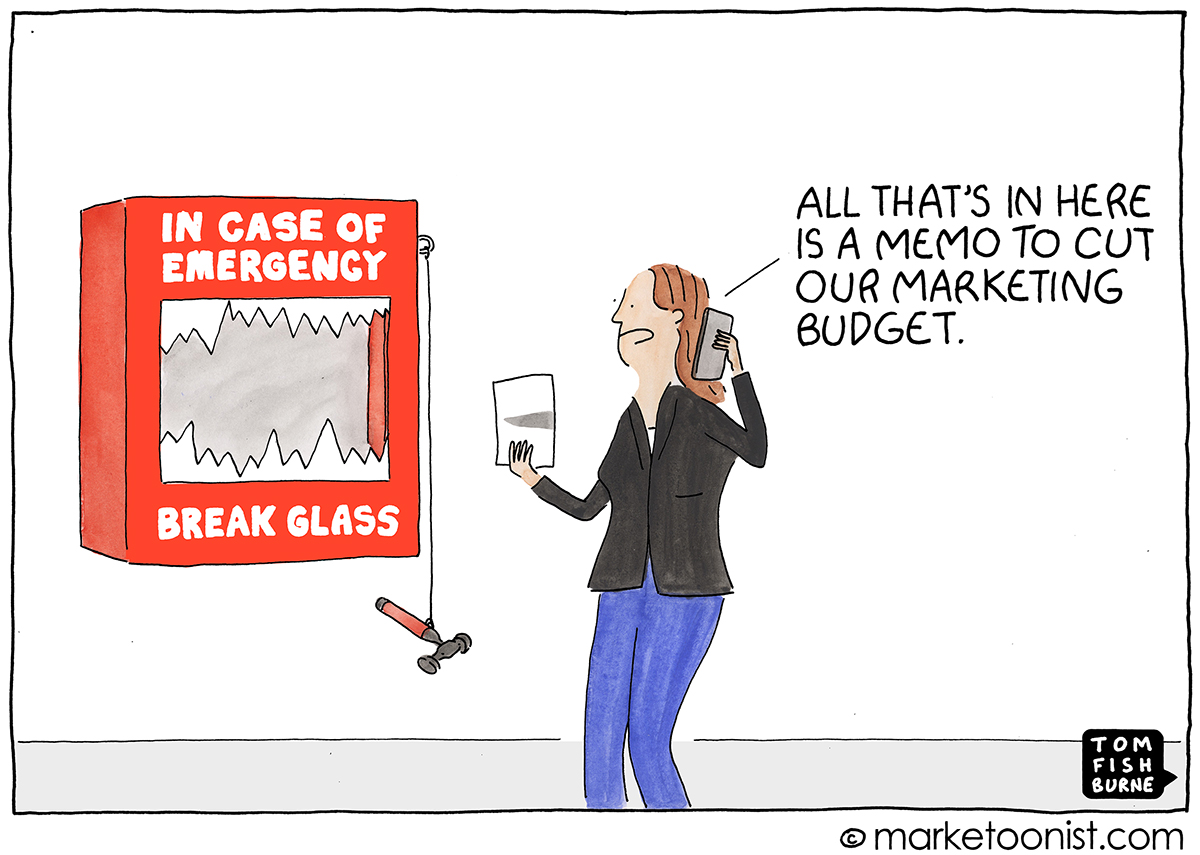

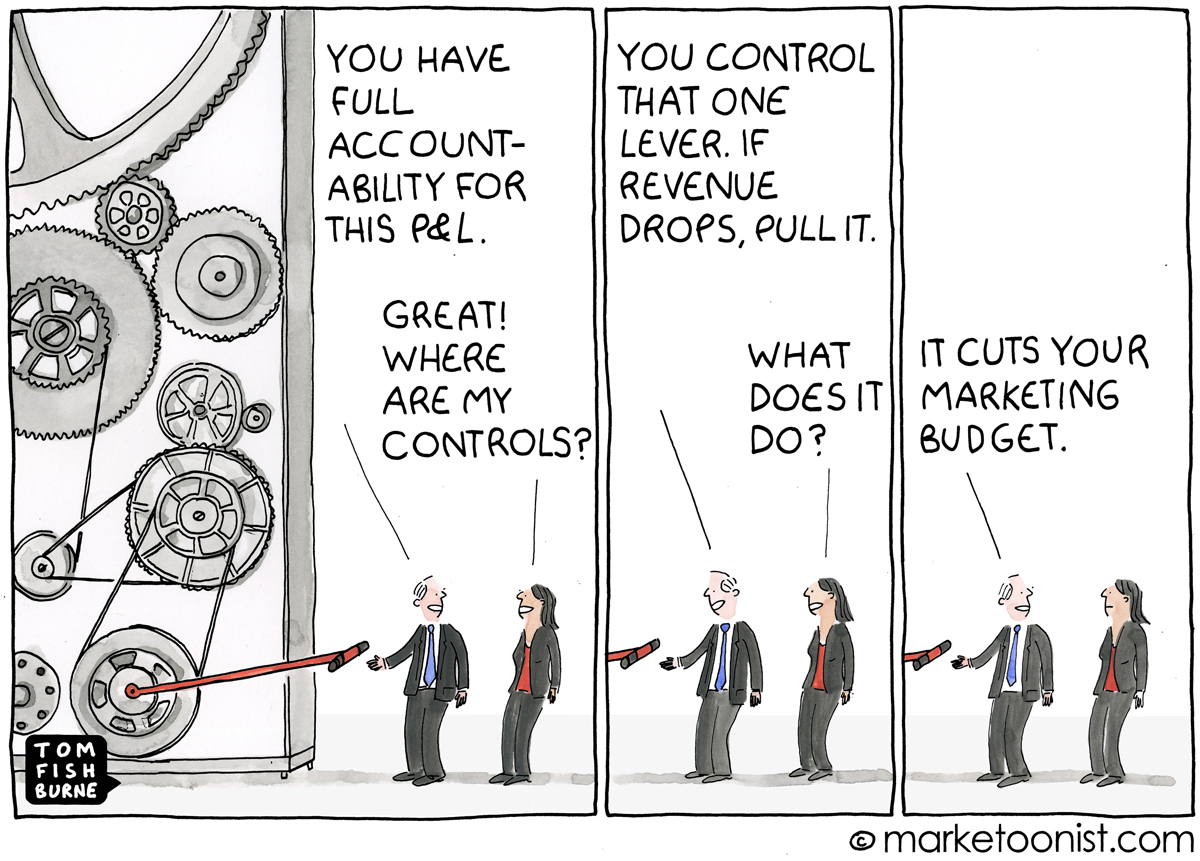

Here are a few related cartoons I’ve drawn over the years: